Know the 3 basic, interesting facts about your credit scores.

A credit score is a three-digit number calculated from your credit report and it is one of the major factors used by lenders to determine your creditworthiness for a mortgage, loan or credit card.

In short, it is a rank or “GPA” for your personal finance and borrowing history. Much like teachers rank students by their GPA, creditors rank loan applicants with their credit scores.

Your score is important as it is a major determinant of whether your loan will be approved, as well as what interest rate you are charged. If you have decent credit scores, you are more likely to obtain loans at better interest rate than someone who has a worse credit scores.

In this article, we explore the 3 basic facts you must know about credit scores and how it can affect your financial life tremendously.

read: 3 facts about credit report you must know

Fact 1: There Are More Than One Credit Score System, But Only FICO Dominates

There are multiple credit-scoring models in existence, but only one credit scoring system dominates the market – the FICO credit score. According to MyFICO.com, the consumer website for the FICO score developer, 90% of all financial institutes in the U.S. use FICO scores in their decision making process.

An individual has 3 FICO scores, one from each credit report provided by the 3 major credit bureaus – Equifax, Experian and TransUnion. If you want to learn more about the credit bureaus and credit reports, please read this article.

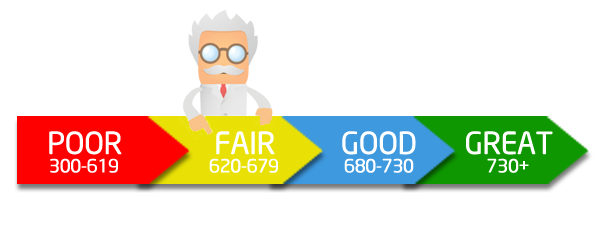

FICO scores range from 300 to 850, with a higher score indicates a better rank and lower risk for the creditors. FICO score by itself is a risk predictor, where a consumer with a higher score is less likely to become delinquent on credit obligations (e.g. paying off debts in a timely manner) in the next 24 months after scoring.

Although there is no defined ranges for bad and good credits, we can generally categorize FICO credit scores as follow:

- Excellent Credit: 781 – 850

- Good Credit: 661-780

- Fair Credit: 601-660

- Poor Credit: 501-600

- Bad Credit: below 500

Obviously, a decent score will gives you a better chance at securing better loans, rentals, and interest rates. Unfortunately, you can’t view your credit score for free unlike credit reports where you can order with no charge annually from Annualcreditreport.com. You can purchase your scores from all 3 bureaus from MyFICO.com.

Fact 2: Your FICO Score Can Vary Significantly Depending On Credit Bureaus

As stated just now, every U.S. consumer has 3 FICO scores, one each from Equifax, Experian and TransUnion. Each bureau tracks information about how consumers use credit independently.

As a result, each credit bureau typically has different information about your credit history, and the FICO credit score generated by each of them also tends to vary, and sometimes significantly.

Why do we need 3 credit bureaus instead of just one since they basically do the same thing? It is primarily due to history. You see, credit reporting has been around for over 100 years.

More than a century ago, credit reporting officers went from merchant to merchant in a town or city to take notes on how individuals repaid their debts. The notes are then stored in local credit bureau files.

Eventually, credit reporting expanded, automated and consolidated into 3 regional credit reporting companies. Experian, formerly TRW, expanded in the west. TransUnion, based in Chicago and evolved within central of United States. Equifax, based in Atlanta, dominated the south and the east.

With the rise of computing technology, the 3 regional credit reporting companies all gained national exposure and became competitors. While they are basically doing the same thing, each has differences in how they functions, resulting in different reporting and credit scores.

Fact 3: Your Credit Scores Affect A Lot More Than Just Your Credit

When it comes to the importance of having good credit scores, most people think of qualifying for a new car loan, home mortgage, or credit card. But the fact is having a good credit score affects a lot more than just applying for a loan.

For example, your credit scores will determine how much you pay for auto insurance. Landlords will likely check your credit scores before approving your rental application. Nowadays many employers even pull credit reports and credit scores on potential employees.

Employment consultants say a troubling credit score may cause hiring officers to question an applicant more closely. Vic Tanon, chief simplicity officer at Emplicity (an organization that consults hiring practices across U.S.), says that a bad credit score is likely to be a more important factor in hiring process in certain industries such as finance services.

For consumers who want to rent a house, do take note that potential landlords have the right to check your credit score at your expense. Landlords typically obtain permission from the applicant, though technically a written permission is not required.

Landlords often pass the cost of credit checks to the applicant in the form of application fees. In a lot of cases, the applicants do not have a choice but to pay for it. Therefore it is important to maintain a good score to reduce the chances of getting rejected.

The Bottom Line

It is a good idea to check your credit score from time to time to make sure you are in good shape. You can check your own credit reports and credit scores without adverse effects on your ratings.

You can purchase your credit score directly from MyFICO.com or any of the 3 credit reporting agencies. In the next article, we will discuss the components of the FICO scores and how you can improve your scores.

Leave a Reply