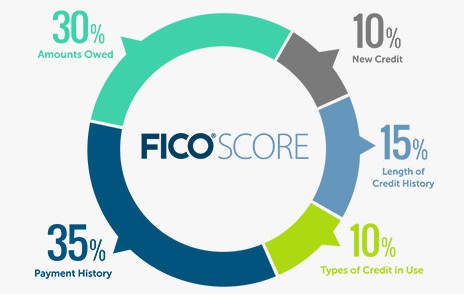

Understand Credit Score – the FICO scoring model. Source: MyFICO.com.

Whether you are renting or buying a home, applying for a car loan or simply a new credit card – lenders want to know the risk when they lend money to you. To them, you are not a friend, not a family member – you are a stranger they have only met for the first time and they know nothing about you.

To determine the risk of you delaying payments or defaulting on a loan, they judge your credit risk by looking at your credit scores. FICO scores are the credit scores used by 90% of top lenders as a benchmark. Naturally, as consumers, we want to understand what goes into our credit scores and have some control over it.

Understanding How Credit Scores Are Calculated

FICO takes the information from your credit reports and sort them into 5 major categories, with some factors more heavily considered. We will go through each of the element from the most heavily weighted to the least and offer advices to improve your score.

Payment history (35%)

Your account payment information, including any delinquencies and public records.

The first thing potential lenders wants to know is whether you have paid past credit accounts on time. That’s why this is the most important factor in FICO scores.

A few late payments will not necessarily put you in a bad spot. An overall good credit health can generally outweigh one or two instances of late credit card payments.

Having no late payments on credit cards will certainly improve your score, but it doesn’t necessarily guarantee you a perfect score, either. Payment history is just one part of your FICO score calculation after all.

Lesson: Pay your credit card debts every month and avoid late payments. If possible, pay more than the minimum sum to shorten your repayment period and pay less on interests.

Read more about strategies to credit card debt clearance here.

Amounts owned (30%)

How much you owe under your accounts. The amount of available credit you are using on revolving accounts are heavily factored.

Owing money on credit accounts and your credit cards doesn’t mean you are a high-risk borrower with low FICO scores. For example, if you borrowed $15,000 to buy a car and paid off $5,000, you have paid off 33% of your loan and is a good sign that you are willing to pay back your debt.

However, when a high percentage of an individual’s available credit has been used, it is usually a red flag that FICO looks out for. This usually means that the person is overextended on credit, and is more likely to make late payments or miss payments altogether.

In addition to overall amount you owe, FICO takes into account the amount you owe on specific accounts. Revolving accounts such as credit cards are more heavily factored than say, your mortgage where you have fixed payments.

In some cases, having some small credit without missing payments is a good sign that you manage your debts well and can be better than carrying no balance at all. Therefore, having a low credit utilization can be better than having a high one, or none at all.

Lesson: Do not accumulate balances on many credit cards as it can be a sign of over-extension. Focus on using just 2 to 3 credit cards and make sure you don’t rack up big debts and miss payments.

Length of credit history (15%)

The age of your credit account (how long you’ve had your account) and time since account activity.

There’s a saying in the credit industry: “The best credit is old credit.”

When evaluating the length of credit history, FICO takes into account the ages of your oldest and newest accounts, as well as the average age of all your accounts.

The minimum amount of credit history required to generate a FICO score is 6 months, and a FICO score can be generated even if a consumer has only one credit account.

You can close an account and it will still appear on your credit report. For example, an account closed 5 years ago can still extend your credit history as long as it’s still present in your credit report.

However, whether it helps or hurts your credit score depending on your payment history. Closed accounts that have always been paid on time remain on credit reports for 10 years from the date of closure or last account update, while accounts with late payments remain on credit reports for 7 years from the date of first delinquency.

Lesson: Maintain a good payment history on your credit cards as they will remain in your credit reports for at least a few years. Sticking to your old credit cards is generally a good idea to achieve a lengthy credit history.

Types of credits in use (10%)

The mix of accounts you have, such as revolving accounts and installment accounts.

If you are still not sure exactly of the difference between revolving accounts and installment accounts, the brief descriptions below are for you:

Revolving Accounts

Not issued in predetermined amount. You have a limit of how much you can borrow (think credit line and credit cards), but how much you want to borrow up to the limit is up to you. Most revolving accounts are opened as lines of credits, where consumers make charges on the accounts and pay them off.

Installment Accounts

Loans that you pay back in predetermined payments every month. The amount of the loan is determined the moment you are approved, and the sum you’ve borrowed doesn’t change over time. Examples of installment credit include mortgage and car loans.

Having credit cards and installment loans with good payment history will raise your FICO scores. People with no credit cards are often viewed as having more credit risk than someone with small balance on a few credit cards.

Lesson: Most consumers inevitably have to take up installment loans at some point, but credit cards can be optional. Have a few credit cards, but manage them responsibly. Keep only small balance and pay them off regularly.

New credit (10%)

Your pursuit of new credit, including credit inquiries and number of recently opened accounts.

Let’s make things clear – checking for your credit report and credit scores will not hurt your scores, as long as you do it through organizations authorized to provide legitimate credit reports (AnnualCreditReport.com) and credit scores (MyFico.com).

However, if you have been managing credit for a short period of time, opening multiple credit accounts in short succession can lower your average accounts age, and can potentially lower your credit scores.

Research shows that opening several new credit accounts in a short period of time represents a greater credit risk, especially for people without long credit history. This is why FICO takes into account how you shop for credit cards.

Lesson: It’s OK to check your credit reports and credit scores, but do not open new credit accounts rapidly. Keep to just a few credit cards and maintain good records on them.

The Bottom Line

Understanding how your FICO credit score works is an important step to better your personal finance.

Keep in mind – 90% of lenders use FICO scores as a benchmark. Whether you are applying for a car loan, mortgage, or any personal loans, there is a great chance you are evaluated with your FICO credit score.

If you have followed the article thoroughly, you will realize that the best practices of building and maintaining good credit scores can be boiled down to just a few simple pointers:

- Keep just a few essential credit cards, preferably for longer period of time

- Pay off major credit debts and maintain just small credit balances on them

- Pay off your credit balances regularly and on time

- Do not apply for new credit cards rapidly

Leave a Reply