There are a million ways to save money, but some matters more than others.

Everybody wants more money in their bank account. If you want to do it quick, you have to learn the most effective ways that can potentially save you big bucks.

No doubt, clipping coupons and cutting out small expenses here and there can eventually add up, but there are larger leaks in your finances that you need to look into.

Today we look at 5 ways to reduce costs and put more money in your wallet, without making a sacrifice to your lifestyle.

How to Save Money Quickly

Surprisingly, saving big money quickly isn’t as complicated as you may think. Here are 5 strategies that provide high returns without having to give up on your daily Starbucks coffee:

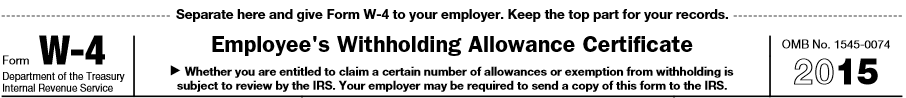

Adjust Your Tax Withholding (a.k.a Form W-4)

The Form W-4 is an Internal Revenue Service (IRS) form that employees complete to inform their employer how much money to withhold from their paycheck for federal taxes.

You should complete your W-4 if you haven’t, and give it to your employer so they can withhold the correct federal income tax from your pay.

What can you achieve from this? You receive more money in your next paycheck without having to get a raise from your boss (although that’s not too bad, either).

Majority of tax-payer are overpaying the IRS, and they receive a tax refund every year. Those who receive a refund of $2,400 last year can boost their monthly take-home pay by $200 after adjusting the withholding.

What you can do with the extra paycheck is to invest them into a well diversified index fund periodically, and enjoy market growth throughout the year.

Refinance Your Home Mortgage

Many people make the mistake of not reviewing their mortgage repayment plan often enough. Mortgage is the biggest financial commitment for most of us, so it is only natural that we try to save money on it.

If you haven’t been following the current mortgage interest rates for some time, you may want to compare the current rate to the one you have. Chances are it makes sense to refinance your home, now that the interest rates are more favorable.

Even if the interest rates are not much better, consider refinancing your 30-years mortgage into a 15-years one.

Refinancing into a shorter repayment period will net you a more favorable interest rate and save you thousands of dollars in the process. Your monthly payment may increase slightly, but you are saving much more in the long term.

At the minimum, aim to pay off your mortgage before your desired retirement age.

read: 13 Biggest Money Mistakes People Make

Review Your Investment Portfolio

If you invest in mutual funds and ETFs, you should review your investment portfolio for funds that charge a high management and account maintenance fees.

Look into your funds’ prospectus closely to sniff out hidden fees and find the expense ratio of your funds.

An expense ratio is the fund’s annual operating costs relative to its average net assets. For example, an actively managed mutual fund may have an expense ratio of 1 to 2%, while an index fund may range between 0.1% to 0.25%.

This amount is removed from the fund’s earnings before the profits are being distributed to the investors. Therefore, a lower expense ratio means a larger percentage of profit is being shared with the investors.

If you find a comparable mutual fund or ETF with a lower expense ratio, always go for the lower one. A difference of 0.5% in expense ratio in a portfolio of $100,000 can save you $500 in just a year.

Raise Your Insurance Deductibles

According to Insurance Information Institute (III.org), raising your insurance deductibles is one of the best ways to save money on homeowners and auto insurance policy.

For the uninformed, a deductible is basically the amount “deducted” from an insured loss.

Let’s say you raise a $500 deductible on a homeowners insurance to $1,000. If the insurance company determines that you have an insured loss of $10,000, the company will cover $9,000 dollars of your losses. You will have to cover the remaining $1,000 from your own pockets.

Generally speaking, the larger the deductibles, the less a consumer pays in premium for the insurance policy.

Raising deductible from $200 to $500 can reduce collision and comprehensive coverage premium by 15% to 30%. The amount can differ a lot among states as the rates vary significantly depending on where you live.

However, keep in mind that while you save a lot from the monthly premium, you will be responsible for a larger deductible should an accident happens.

The best way is to find your sweet spot between paying less premiums with higher deductibles, or vice versa.

Take Advantage of 0% Credit Cards

If you carry a substantial balance on a credit card with a high interest rate, you should consider transferring your balance to a 0% credit card, provided you have a good credit score.

Generally, if you hold a credit score of 700 or higher, you will be eligible for a balance transfer to a card with a very low interest rate, if not 0% introductory rate.

You can achieve tremendous savings just by using this strategy alone.

MagnifyMoney did a survey and found that those who carry a balance on their card and have a credit score of more than 700 rack up an average of $9,500 debt on their card.

If the card’s interest rate is 15% and these borrowers make $500 monthly payment, they will pay about $1,097 in interests within the next year.

By transferring this balance to a 0% credit card, they will be saving $1,097 in just 12 months time.

Of course, the best strategy would be to pay off the entire balance within the 0% introductory rate period, and never carry a balance on the credit card again.

Leave a Reply