Does your credit score need fixing?

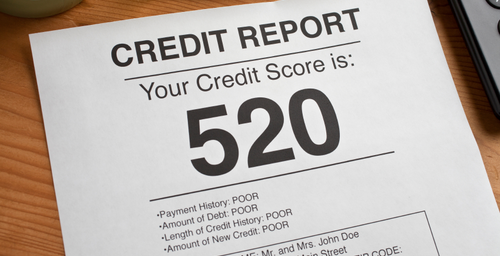

Although the companies that develop credit scores – such as FICO does not decide which credit scores are “good” or “bad”, most people have a gut feeling about their credit score. It’s either great, good, or bad. But what is a bad credit score really?

It is up to individual lenders and insurance companies who use applicants’ credit scores to decide if the applicant is a good fit. Therefore, there is no defined bad credit score per se, it is up to the lenders to decide what score is a bad score.

With that said, there are some assumptions that can be made about credit scores that fall within certain ranges. When you are reviewing your credit score, you can generally fit them into categories below:

- Excellent Credit: 781 – 850

- Good Credit: 661-780

- Fair Credit: 601-660

- Poor Credit: 501-600

- Bad Credit: below 500

If you are at poor credit or below, consider your credit score needs fixing. Today we’ll examine how you can improve a low credit score by yourself.

The Basics of Credit Scores Fixing is to Do It Yourself

You have probably seen the advertisements in newspapers, on TV, and on the internet for credit score repair services. You even hear them on the radio, get fliers in your mailboxes, and they all make the same claims:

- “Credit problems? No problems!”

- “We erase your bad credits, 100% guaranteed!”

- “We remove bankruptcies, liens, bad loans from your credit history!”

Sounds familiar? Do yourself a favor and don’t fall for these claims. These credit repair services are very likely scams. Attorneys at the Federal Trade Commissions, the nation’s consumer protection agency, say that they have never seen a legitimate credit repair agency make these claims.

These scams will most likely take your money, leave you with an even worse credit score than you already have, and then disappear altogether.

The truth is, there is no legal and real quick way to fix a bad credit score. You can improve your credit report legitimately, but it takes a bit of time and effort to stick to your personal debt repayment plan. In most cases, you can see improvement within 30 to 60 days, which is not too bad at all.

Fortunately, you can carry out credit repair on your own without paying a dime for any services (you still have to pay towards your debts, of course).

3 Important Steps You Can Take Right Now

The best advice for rebuilding credit score is to manage your credit responsibly over time. If you haven’t done that, fixing your credit history is the first step you should take before seeing improvements in your credit score.

Step 1: Check Your Credit Report

Credit scores are calculated with the information from your credit reports, so it is only common sense to start repairing your credit from your credit reports.

If you haven’t requested your free annual credit reports, you can request a free copy from each of the 3 credit bureaus and check it for errors.

The information in your credit reports may contain errors, and it is your job to check and make sure that there are no late payments or credit card debts listed incorrectly for any of your accounts. Also check to make sure the amounts owed for each of your open accounts are correct and up-to-date.

If you find errors on any of your reports, dispute them on your credit bureau. Read this article for more details on how to fix a bad credit report.

Step 2: Setup Payment Reminders

Did you know that your payment history makes up the largest percentage in your credit score calculation? A whopping 35% of your credit score depends on a good payment history. It is only natural that you want to make payments on time to prevent not only costly late charges, but to boost your credit scores tremendously.

Most banks offer payment reminders and even auto pay features nowadays through their internet banking portals. You can set a reminder to remind yourself a number of days before your payment is due, in the forms of emails and text messages.

If you are having difficulty paying on time even with the reminders, consider enrolling into automatic payments to have the credit card and loan providers deduct the payments from your designated bank account. If you can’t afford to pay in full every month, you can choose to pay the minimum sum.

However, we strongly recommend that you pay more than minimum sum to clear your debts quicker and minimize compound interests on your debts, which can roll out of control before you know it.

Step 3: Reduce Your Credit Debt

To boost a bad credit score, you must be prepared to do one of two things – to cut down your spending or to boost your income. Better yet, do both at the same time so you can free up more cash every month and pay towards your debts.

This is easier said than done, but reducing the amounts that you owe is far more satisfying than improving your credit scores alone. The first thing you need to do is to stop charging your credit cards.

Use your credit reports to list down all your active accounts. Then go to your online portals or check your most recent credit card statements and determine how much you owe in each of the cards. List down the debts from the one with highest interest rate to the lowest, and put the bulk of your budget into clearing the debt with the highest interest first.

read more: how to clear debt fast

Also, aim to reduce your credit card utilization ratio to below 30%, as this is the optimal ratio that gives you the best FICO scores. For example, if you have a credit limit of $1,500, make sure you don’t utilize more than $450 every month.

The Bottom Line

Improving a bad credit score is more about fixing errors (if there is any) and paying off bad debts in your credit history, as well as following a disciplined regimen of using credit cards responsibly. Doing so will guarantee you a good credit history and boost your credit score.

You don’t need to pay credit repair services to “remove” bad credit history as there is no legal way of doing so. Everything that can be done to improve your scores is within your reach, so put in a little bit of patience and discipline and you will see improvement soon.

Leave a Reply