Learn how to fix a bad credit report by yourself.

Your credit score is derived from information found on your credit reports. Therefore, naturally, a bad and inaccurate credit report won’t reflect too well on your credit scores.

If you want to improve your credit score, you have to start from the report.

First, you need to order a free credit report and review it thoroughly to detect any negative misinformation.

Know Your Rights

As a consumer, you have your rights to order a free copy of credit report once a year. You can request a free credit report annually from each of the 3 major credit reporting bureaus – Equifax, Experian and TransUnion.

You can ask for an investigation at no charge to you – if you find any inaccurate, or incomplete information in any one of your credit reports.

Some people choose to hire a credit repair company to investigate for them, but anything the company can legally do, you can do for yourself at almost no costs at all.

Before you decide to pay someone to investigate your credit problems, take a look at the 3 common major problems we find in the credit reports and how you can fix them for yourself.

Problem 1: Past Due Accounts

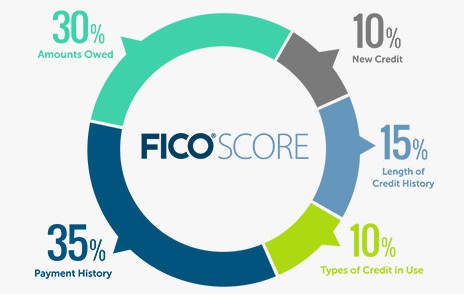

Components that make up your credit score.

If you have looked into the scoring criteria of credit scores, you will realize that your payment history has the largest impact on your credit score. A whopping 35% of your score depends on your payment history.

Therefore, having late payments will hurt your credit scores more than anything else.

If you find any past due accounts in your credit report, including late payments, charge-offs, and collection accounts, make sure they are correct and do not reflect any accounts that have been paid off.

Next, plan a repayment schedule to get current on all delinquent accounts.If you have accounts that are 30 to 60 days late in payment, pay them off as soon as possible to prevent negative impact on your credit scores.

Accounts that are 90 days past due will be considered extremely delinquent and will leave a mark on your credit report, and inflict a negative impact on your scores.

Typically, a debt will go into collection after 180 days past due. If a payment goes into collection account, it can remain in your credit report and hurt your credit scores for up to 7 years, even if you have cleared off the balance.

Problem 2: Over-the-Limit Credit Card Balance

The amounts owed by you is the second most important criterion used to determine your credit score. Your level of debt accounts for 30% of your FICO credit score.

Ideally, your credit card utilization should be below 30% of your overall credit limit. For example, if your credit limit is at $1,000, you should not have more than $300 balance on your card at any point of time to maximize your credit score.

If you find any credit cards in your report with balances over their credit limit, focus on bringing these over-the-limit balances under the limit.

Once you have all the balances within their respective credit limits, aim to pay them down to less than 30% of the credit limit. After that, keep your credit utilization ratio at 30% or lower all the time and you’ll see improvements to your credit score.

If you have problems paying down your debts, learn how you can tackle them systematically and pay them off in the shortest period of time.

Problem 3: Default on Student Loans

Most Americans carry multiple student loans and according to a report by Wall Street Journal, 7 Million student loan borrowers are in default, which translates to about 17% of all borrowers being severely delinquent.

Obviously, if you are in default, it won’t appear pretty on your credit report and credit score. The default will be noted in your report and continue to be visible to potential lenders even if it has been quickly resolved.

However, note that a late payment doesn’t automatically turns into a default. Below is a timeline of late payment on student loans before it’s considered a default:

- As soon as you miss your first payment, you are considered delinquent. This is a red flag for both you and the lenders, but it doesn’t impact your report and score too much.

- When you are 90 days past due, the delinquent status will be reported to all 3 credit bureaus and a negative mark will be left on your credit report.

- When you are 270 days past due, the student loan is considered to be in default. At this point, the loan will go into collection account and you will start receiving calls from collection agencies.

If you have federal or private student loans that are nearing default, get current on your payments, or call your lenders to negotiate a new repayment plan if you cannot afford the current one. Most lenders have several flexible repayment plans to choose from.

The Bottom Line

Before you engage any credit counseling or credit repair company, exercise your rights to obtain a free credit report from each of the credit bureaus, and make sure all information your report is current and accurate.

Pay special attention to any late payments and make sure you don’t over-utilize your credit cards. These are usually the two main culprits that lower your credit scores significantly.

If you need counseling after all, make sure you look out for credit repair scams and go for a reputable credit counseling agency.

You can find a state-by-state list of government-approved credit counseling organizations at U.S. Department of Justice website. Be wary of agencies that claim they are government-approved, but do not appear on the list of approved organizations.

Leave a Reply