3 funds to rule them all

In the previous article, we talked about how index funds routinely beat actively managed mutual funds in the long term view. Over a long period of time, such as in a time frame of more than 10 years, the probability of index funds outperforming actively managed funds gets higher as years get by.

Today we explore the best mutual funds invest strategies. We now know that investing in index funds is the best way to place your hard earned money in the mutual funds market, but how many funds and what kind of index funds should we invest in? What are the best ways to invest in these funds? What is the ideal portfolio given my age, and how much risk can I take?

We will discuss all these questions in this article, so read on.

Diversification Is Key

Diversification is a technique that reduces risk of investing by allocating our investments among various financial instruments or categories. Portfolio diversification helps to maximize returns by investing in different areas that react differently in a same event.

Putting all your money in a single index fund, such as the S&P 500 already provides a pretty good level of diversification and risk management compared to picking and buying just a few stocks, but we can do better by investing in index funds that cover different markets and financial instruments:

- Vanguard Total Stock Market Index Fund

- Vanguard Total International Stock Market Index Fund

- Vanguard Total Bond Market Fund

Why Vanguard funds? All these funds are managed by a client-owned firm that works to keep costs extremely low, with the aim of benefiting the investors. With only these 3 funds, investors can create a very low cost, broadly diversified portfolio that is very easy to manage and rebalance.

Vanguard Total Stock Market Index Fund (VTSMX) provide investors with exposure to the entire US equity market, including small-, mid-, and large-cap growth and value stocks. It provides broad US market diversification with a low expense ratio of 0.17%.

Vanguard Total International Stock Market Index Fund (VGTSX) provides exposure to both developed and emerging international economies. This fund tracks stock markets all over the globe, except for the US stock market. It complements VTSMX for a total global stock coverage with the expense ratio of 0.22%.

Vanguard Total Bond Market Fund (VBMFX) provides broad exposure to US investment grade bonds by investing about 30% in corporate bonds and 70% in US government bonds of all maturities (short-, intermediate-, and long-term issues). It has an expense ratio of 0.2%.

What Are Bonds and How Do They Work?

Bonds are an essential part of a long term, diversified portfolio

A bond is a debt investment in which an investor loans money to an entity, such as a corporate or a government which borrows the funds for a defined period of time at a fixed or variable interest rate. If you invest in a bond, you loan money to the these entities, and you receive an interest rate for your investment. Bonds are also commonly referred to as fixed-income securities because we know the returns in advance.

For example, a 5% fixed government bond will yield a 5% annual interest rate, or $50 for every $1000 dollars invested. Eventually, the principal will be returned at bond maturity, where the investor will get his initial investment amount back.

Understanding Bonds at Your Stage of Life

Typically, bonds pay interest semi-annually, which means they can provide a predictable stream of income. Due to this characteristic, many people invest in bond to receive the consistent income and also to preserve their capital.

Although they usually provide a lower percentage of return compared to stock/equity market, understanding their role in investment portfolio is especially important in long term income and retirement planning due to their stability and predictability.

Starting Out (20s to 30s)

Goal – Maximize Capital Growth

Horizon and Risk Tolerance – Very long (40 to 50 years), high risk tolerance

At this age, you have a longer horizon of investing your money and time to recover from adverse market movements. Which is to say, you are at a better position to consider investing a large proportion of your portfolio in higher-yield, higher-risk funds and a low proportion in bonds. Even if you don’t have much money to invest in the market, you have the advantage of time and compounding interest on your side. Just start investing and you will thank yourself a decade later.

Middle Age (30s to 50s)

Goal – Capital Growth

Horizon and Risk Tolerance – Long (20 to 40 years), moderate risk tolerance

If you are at this age, you are probably earning enough to live more comfortably than when you were younger, but are increasingly concerned about funding your retirement and paying for your children’s education. If you did not start saving and investing when you were younger, it’s time to make up for the lost time by starting to invest now. Your goal at this point is to both grow and preserve your capital, because you do not have as much time to wait for market recovery if it moves adversely. You should invest moderately into both bonds and stocks/equity for a balanced portfolio.

Nearing Retirement (50s to 60s)

Goal – Capital Preservation

Horizon and Risk Tolerance – Moderate (10 to 20 years), low risk tolerance

Hopefully by this point, your hard work and discipline of creating income assets, saving and investing has already created a solid nest egg and portfolio that served your financially free lifestyle for some time. You want to protect your portfolio from market volatility more aggressively than any other stage of life because you are depending on this income more than ever to fund your desired lifestyle. Most advisors suggest to people at this stage to increase bond allocation to more than 50% of the total portfolio to provide stability and steady income.

Rule of Thumb for Portfolio Allocation

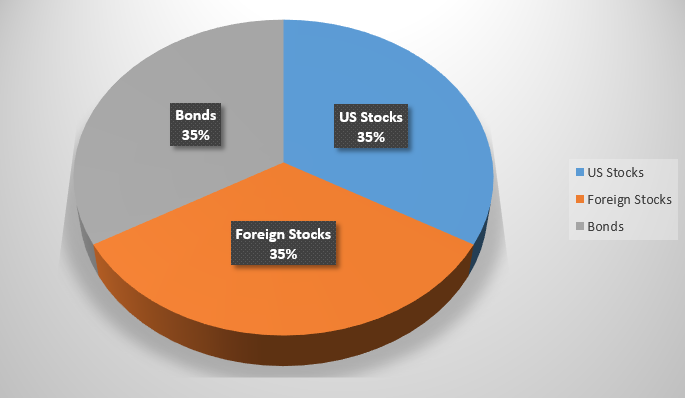

An example of balanced index fund portfolio for someone at age 35

One way to proper index fund allocation is to calculate the proportion of bonds first, and supplement the rest with stock/equity index funds. A general rule of thumb is to purchase bonds to the percentage equal to the age of the portfolio holder.

For instance, someone at the age of 30 is capable of holding a higher-risk portfolio, so he can include 30% bonds (VBMFX) in this entire portfolio. Someone at the age of 55, in contrast needs to preserve his capital and rely more on consistent income of bonds, so he can purchase 55% bonds in his portfolio.

The rest of the portfolio can be comprised of local (VTSMX) and global (VGTSX) stock/equity index funds with equal proportions. For those who have a higher appetite for risk or has another income producing asset supplementing your lifestyle, you can afford to reduce the bonds allocation by 10% relative to your age, i.e. 20% bond allocation at age 30 to take more risk and enjoy a higher potential of returns on your investments.

Higher Risk | Balanced Portfolio | Lower Risk |

|

|---|---|---|---|

| Vanguard Total Bond Market Fund (VBMFX) | 20% | 30% | 40% |

| Vanguard Total Stock Market Fund (VTSMX) | 40% | 35% | 30% |

| Vanguard Total International Stock Market Index Fund (VGTSX) | 40% | 35% | 30% |

Examples of portfolio allocation for someone at age 30

With a proper allocation of just 3 index funds, you can benefit from low cost and broad diversification while exposing yourself to the stock market to enjoy the passive income. You don’t need to research funds or even hold multiple company stocks to get diversified when these 3 best buys can do it just fine.

Leave a Reply